How to Fill Form 15G 2023 ? YouTube

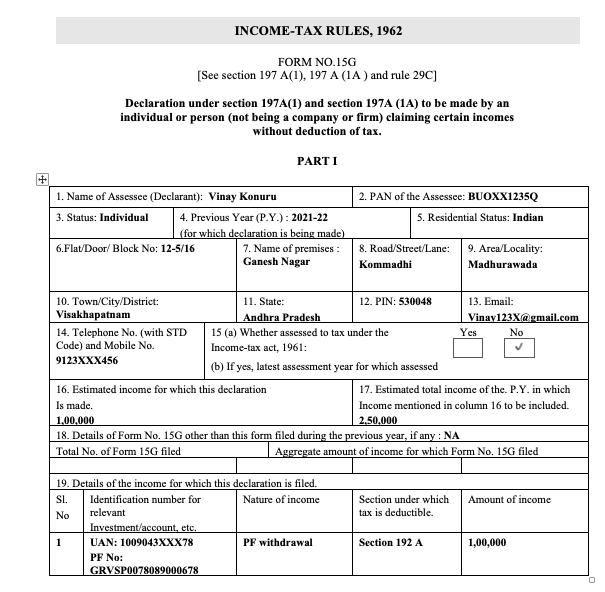

3. Declare the withdrawal amount: Mention the total estimated income of the financial year in which you plan to withdraw the PF. 4. Avoid TDS deductions: If you want to avoid TDS deductions, fill out Form 15G and submit it to the bank branch or EPFO regional office. Form 15G is mandatory if you don't want TDS to be deducted from the PF withdrawal amount.

Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G

Form 15G is a self-declaration form submitted by the assessee to ensure no deduction of TDS on interest income earned in the financial year. The tax on total income must be nil along with a few other conditions. You can file the Form 15G or Form 15H by logging into your internet banking account. Scripbox Recommended Tax Saving Fund

Form 15g filled sample Fill out & sign online DocHub

Below mentioned is the method to download Form 15G online: You are enabled to download PF Withdrawal Form 15G via the online portal EPFO. Tap on the online services, tap on the online claim and then tap on the needed information. Verify the last 4 digits of the phone number, and your PF withdrawal form will be visible.

Sample Filled Form 15G for PF Withdrawal in 2022

The direct link to download Form 15G is given below: Click Here To Download Form 15G PDF For EPF Withdrawl You can either download EPF Form 15G ODF from the above link or also can check the procedure to download the same from the official website. The steps to download 15G Form Online for PF withdrawal are listed below:

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with Sample Filled Form 2016

Fill in Part I (You don't have to fill Part II). Upload the Form in PDF format (if you have image, steps to convert image to pdf are given below) Enter other details and follow the process as explained in Online EPF Withdrawal: How to do Full or Partial EPF Verify Bank Details before EPF Withdrawal Verify Bank Details

How to Download Form 15G Online PDF How to fill Form 15G

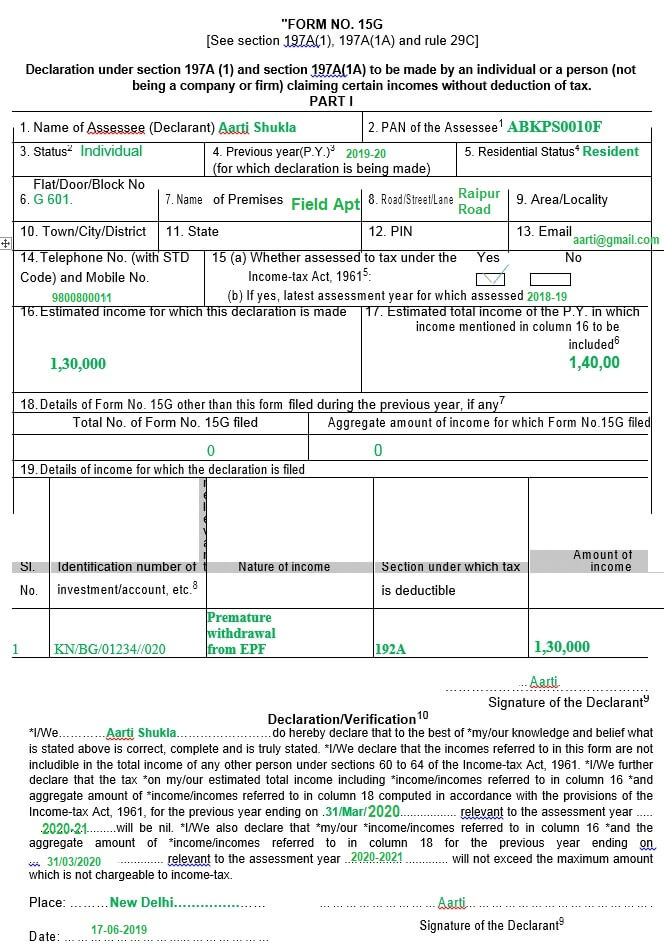

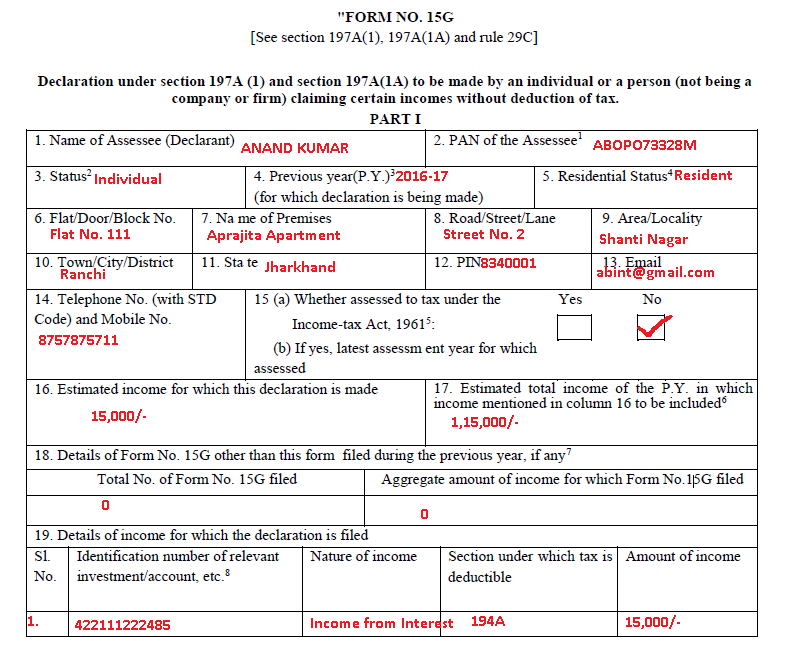

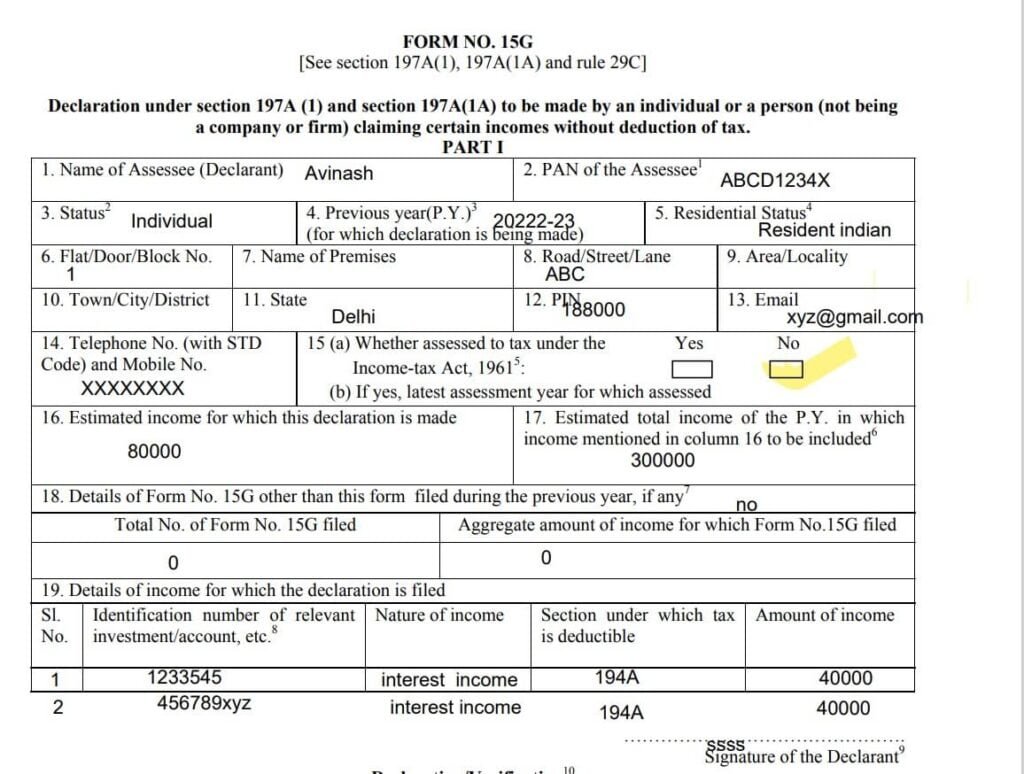

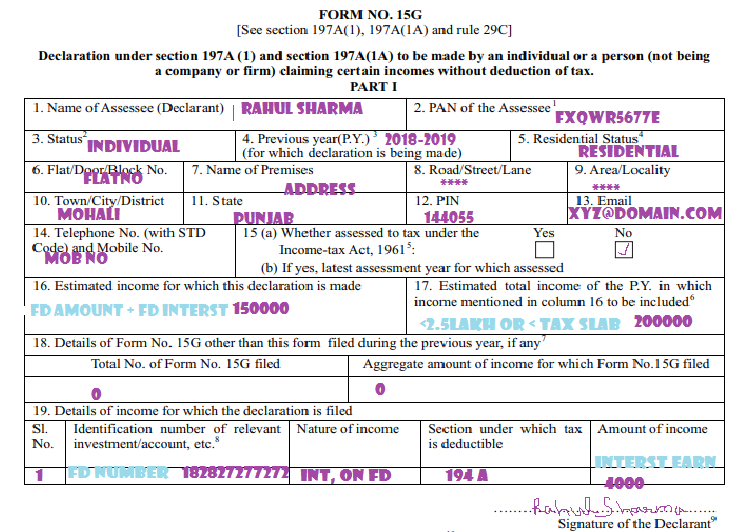

Form 15G Filled Sample for PF Withdrawal in 2022 Form 15G consists Two parts, we need to fill only part 1 of form 15G there is no need to fill part 2 of form 15G, just leave that page blank. Here is an example of a sample filled form 15G part 1 and part 2, which will guide you on how to fill form 15G correctly for PF claim…

Sample Filled Form 15G PDF

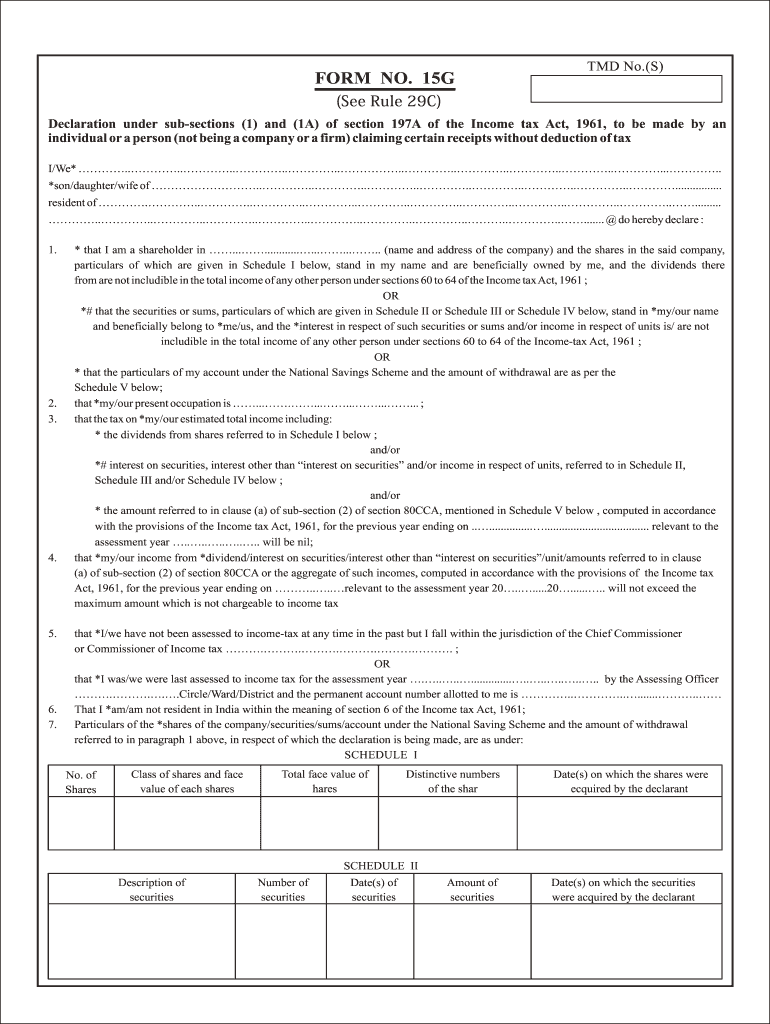

Step 4: Fill out Part 1 of Form 15G and ensure all the details are accurate, and then convert the completed form into a PDF format. Upload the PDF version of the form to finalise the process.. Instructions for Part 2 of Form 15G. The deductor must complete this part and is responsible for depositing the tax deducted at source to the.

15g form fill up Download form 15G

Claim (Form 31, 19, 10C) Verify Last 4 Digits of Bank Acc. Click "I want to apply for". Upload form 15G. 5. Calculate the years of service for PF Claim. The minimum years of service is 5 years doesn't mean that you have to complete the 5 years on the same organisation. If you have completed 4 years in company1 and another 4 years in.

Form 15G For PF How to Download and Fill Form 15G For PF

The post covers the following: Who is eligible to submit Form 15G and Form 15H? Where can Form 15G and Form 15H be used? Step by Step guide to fill the form along with Filled Form 15G Sample & Form 15H Sample Who can submit Form 15G and Form 15H? Form 15H is meant for senior citizens while Form 15G is meant for all other individuals and HUFs.

How to Fill Form 15G for PF Withdrawal in 2022 YouTube

Form 15G is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and HUFs) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST Guntur

Step 2: Once you log in, click on the online services drop-down list and find "Online Claim (Form 31, 19, 10C).". Step 3: Now, enter the last 4 digit bank account number, as shown below: Step 4: Once you verify your bank details, an EPF Withdrawal form will be displayed. Step 5: Here, you will see the option of uploading FORM -15G, Upload.

Fillable Form 15g Pdf Printable Forms Free Online

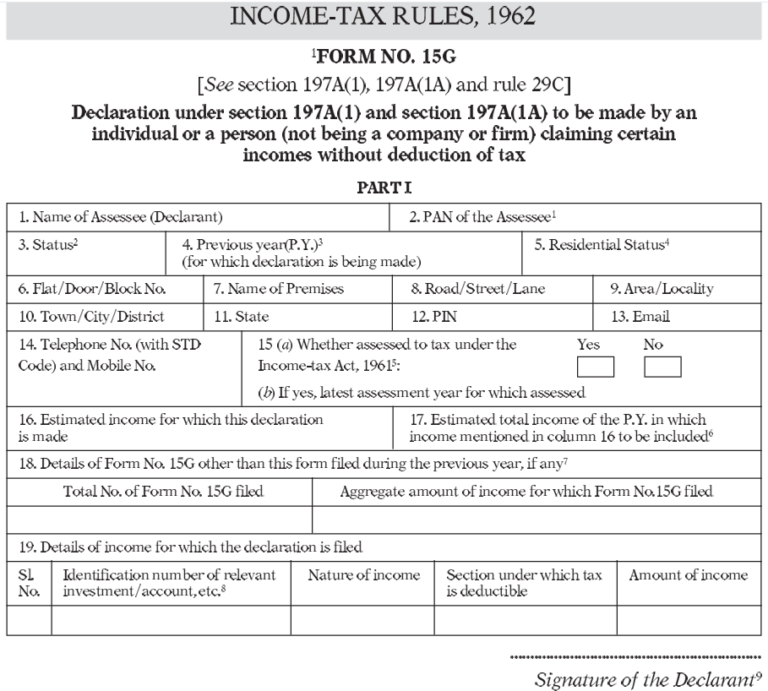

""FORM NO. 15G [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being a. PART II [To be filled by the person responsible for paying the income referred to in column 16 of Part I] 1. Name of the person responsible for paying 2.

தமிழில் How to Fill Form 15G for PF Claim EPFO YouTube

Form 15G or EPF Form 15G is a document people submit to ensure no TDS is deducted on the interest you earn from your EPF, RD or FD. This form can be filled out by individuals below 60 years of age and Hindu Undivided Families (HUFs). For individuals aged 60 years and above have a different form- Form 15H.

Sample Filled Form 15G for PF Withdrawal in 2022 (2022)

Part 1 - This section is to be filled by the person (individual) who wants to claim certain 'incomes' without TDS. Let us now go through each point of Part-1 of Form no 15G. 1 - Name of the individual who is making the declaration. 2 - PAN (Permanent Account Number) of the tax assessee.

Sample Filled Form 15G & 15H for PF Withdrawal in 2021

1: Visit the income tax department website and search for the e-Filing portal 2: Go to the "Downloads" under the login button, click on the 'offline utilities,' and select the 'Other Forms Preparation Utilities.' 3: Next, press the 'Download' link located under the 'Utility' column and extract the download ZIP file.

New Form 15G in Word Format for AY 202223 Download

Know how to fill form 15G for PF withdrawal in 2021-22, and how to submit form 15G in the PF portal online.Download form 15G: https://www.incometaxindia.gov..